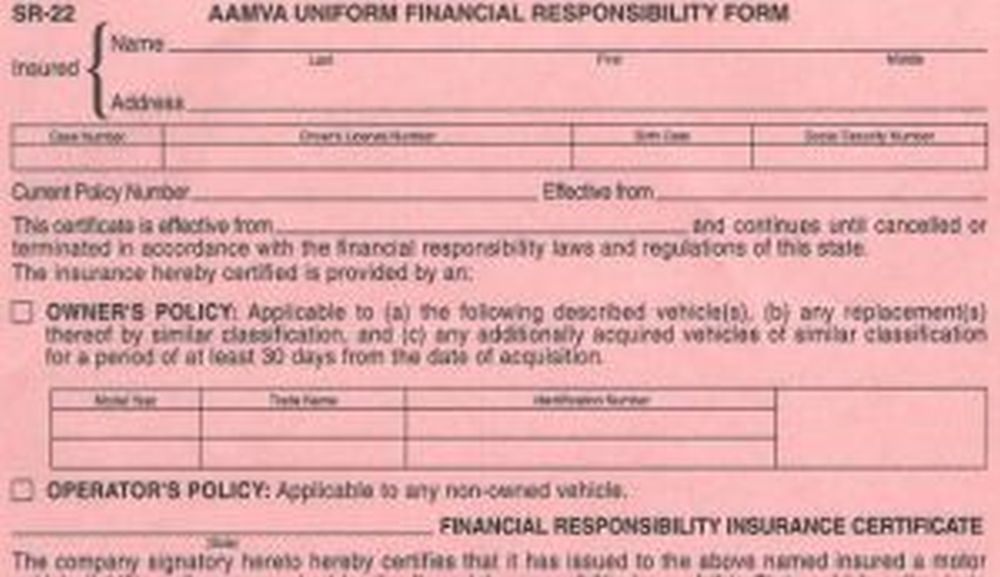

Posted inSR-22

Unearthing the Easiest Way to Get SR-22 Insurance in Texas

Unearthing the Easiest Way to Get SR-22 Insurance in Texas texas is a great place to live in and is known for its diverse population, diverse culture, and friendly atmosphere.…